The following is the first in a series of three blogs addressing the importance of managing attrition in community financial institutions.

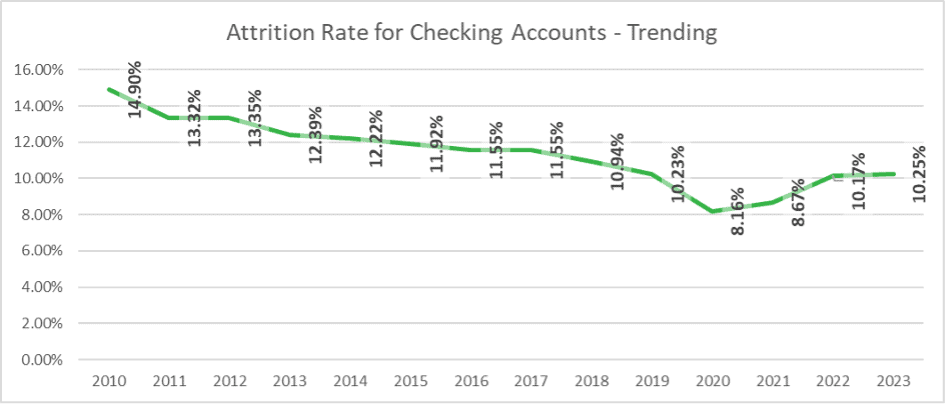

Attrition is a high priority in community FIs these days as the battle for deposits heats up. Since 2010, attrition at community banks—consumers leaving or switching financial institutions—declined from 14.9% to as low as 8.16% in 2020. However, since the pandemic, attrition has been on the rise, pushing 10.25% in 2023.

What is a no- or low-cost way your FI can work with existing customers/members to lower your attrition rates?

First, consider the asset you already have in your frontline staff! Training your employees to deepen relationships with new customers on the first visit can go a long way towards establishing a positive and lasting relationship.

Three things your frontline staff can focus on immediately:

- Offering a smiling friendly face to greet every customer or member (or prospect) who comes into your branch. If your frontline staff generally sits, you might have them stand as they greet visitors.

- Learning new customer/member names plus other (appropriate) details about them to create a sense of familiarity, community, and authenticity.

- Appealing to the senses. What does a new customer or member see/hear/touch/smell when they visit your branch for the first time? Does the frontline staff use the prospect’s name? Is the counter free of clutter? Does the prospect have a brochure they can write on and call their own? Is there coffee brewing?

Second, remember that your best and most fruitful relationships are your existing relationships. In addition to coaching your employees to cultivate new personal relationships, you can help your staff identify more opportunities to better serve existing customers or members.

This will often mean helping them save time and money, make money, achieve peace of mind, or realize a dream. A few examples:

- “Mr. Jones, I see you’re not enrolled in our Mobile Banking. Would you like to save time by depositing checks on your phone instead of coming to the branch? If you have just a few minutes, I can show you how!”

- “Ms. Ramirez, your daughter was just telling me about your trip to Disney later this year! Are you at your savings goals for the trip? Let me tell you about our Roundup Program where we automatically round up each debit purchase to the nearest dollar and transfer the difference to your designated savings account!”

- “I’m so sorry you find the paper statement fee a nuisance, Mr. Chaney. Can I show you how to sign up for eStatements? They are free, and that way you don’t have to pay for paper statements. Many of our customers find they don’t miss paper anymore!”

Did you know approximately 35% of bank customers and credit union members are single-product households? Think about that: It means there is so much opportunity for you to leverage both your product and service utilization, all while lowering your consumer attrition! The more your customers or members know about your products and services, the more they will have beyond a simple checking account. And the more products they have, the less likely they are to leave your community FI.

People may think banking is all about money and numbers, but it truly is all about relationships. How you treat your newest prospects and current customers/members is a harbinger of your future attrition rates. With that in mind, how can you improve accountholder relationships with the frontline staff you already have?