Challenge

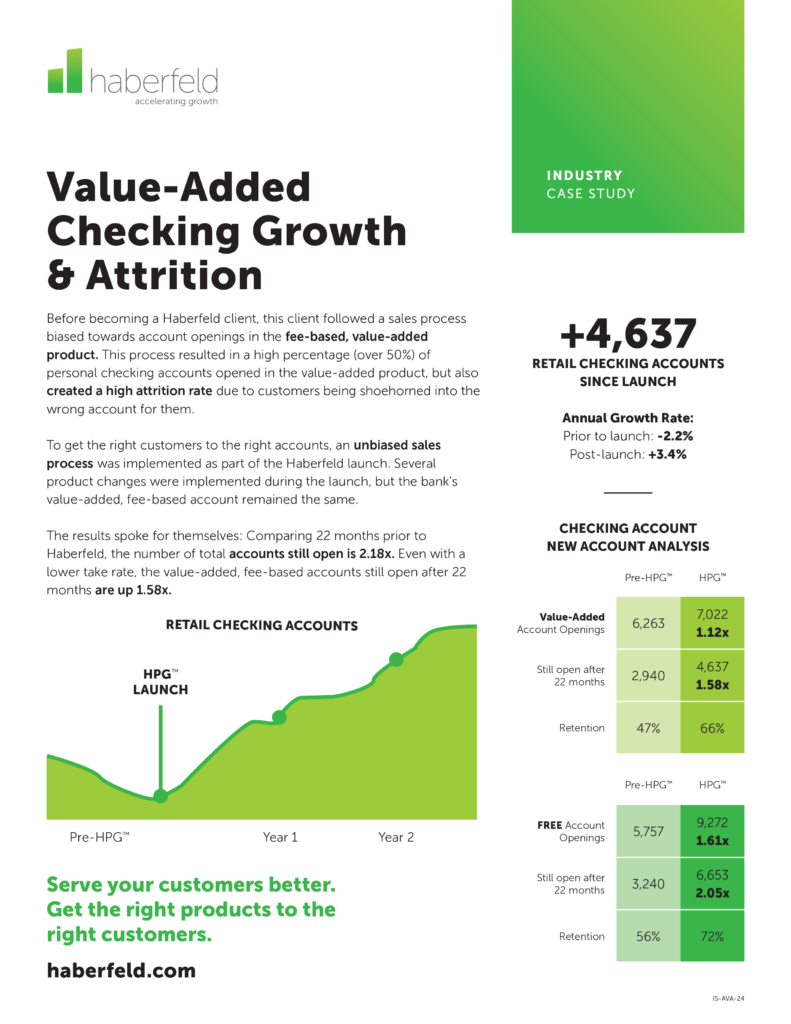

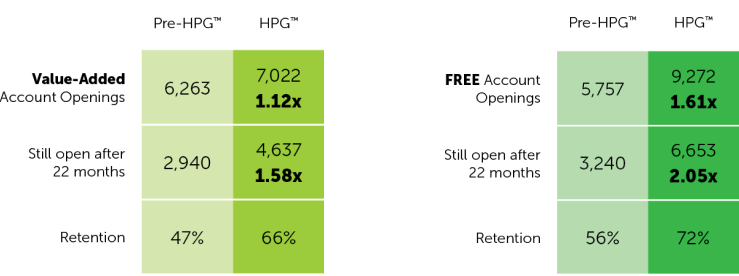

Before becoming a Haberfeld client, this client followed a sales process biased towards account openings in the fee-based, value-added product. This process resulted in a high percentage (over 50%) of personal checking accounts opened in the value-added product, but also created a high attrition rate due to customers being shoehorned into the wrong account for them.

Solution

To get the right customers to the right accounts, an unbiased sales process was implemented as part of the Haberfeld launch. Several product changes were implemented during the launch, but the bank’s value-added, fee-based account remained the same.

Results

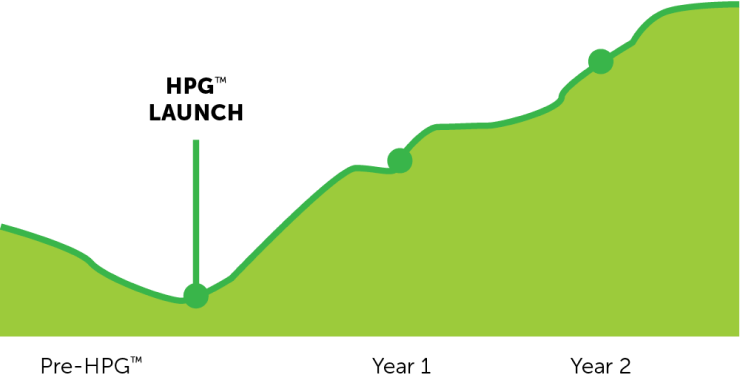

The results spoke for themselves: Comparing 22 months prior to Haberfeld, the number of total accounts still open is 2.18x. Even with a lower take rate, the value-added, fee-based accounts still open after 22 months are up 1.58x.

Improvement Overview

Retail Checking Accounts Since Launch:

+4,637

Annual Growth Rate:

Prior to launch: -2.2%

Post-launch: +3.4%

Checking Account New Account Analysis

Retail Checking Accounts