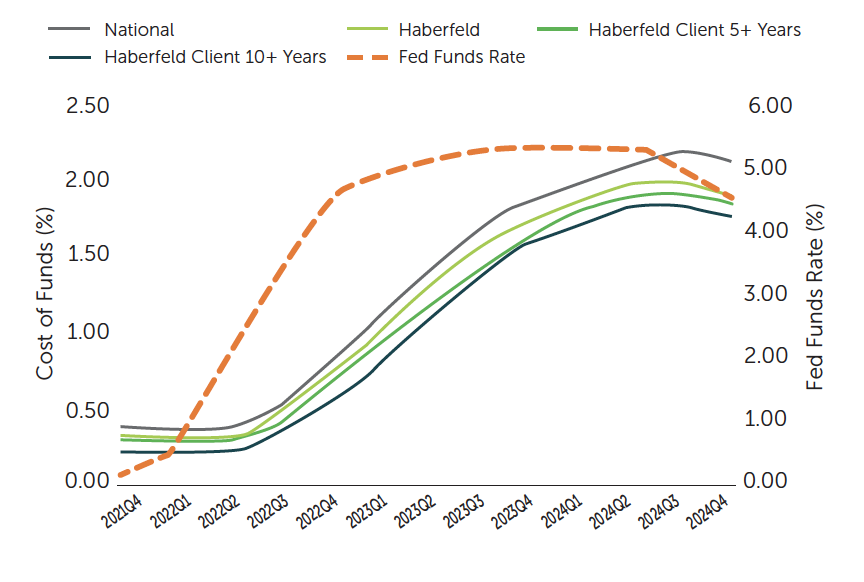

This study examined cost of funds trends comparing Haberfeld clients, by tenure, to overall banking industry performance.

As the Fed aggressively increased rates (orange line), the cost of funds climbed gradually before a rapid growth from 2022Q4 through 2024Q4. Haberfeld clients were not immune to raising funding costs, but they began the period with a lower cost of funds and experienced less of an acceleration:

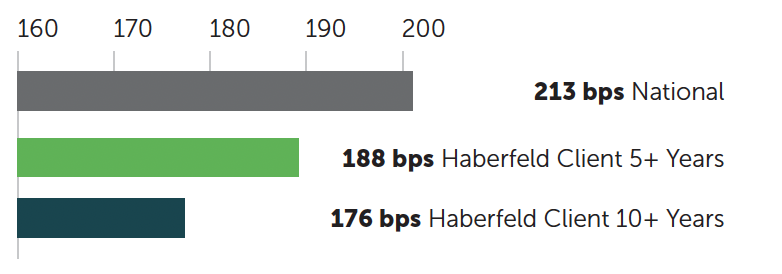

AVERAGE COST OF FUNDS CHANGE VS THE INDUSTRY

Haberfeld clients enjoy a powerful cost of funds advantage over the industry, and this advantage widens with tenure. A 22 bps difference in cost of funds results in about $2.2M in savings for each $1B in funding.

Tenured Haberfeld clients’ COF was 37 bps better than the industry as of 2024Q4.

AVERAGE COST OF FUNDS BY QUARTER