The following is the third and final blog in our three-part series addressing the importance of managing attrition for community financial institutions.

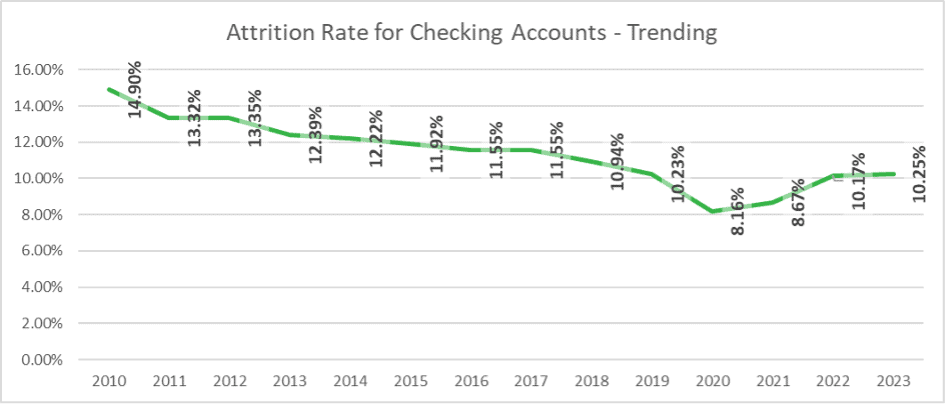

There is no secret that attrition is a high priority for community FIs these days as the battle for deposits heats up. Beginning in 2010, attrition at community banks—consumers leaving or switching financial institutions—declined from 14.9% to as low as 8.16% in 2020. However, since the pandemic, attrition has been on the rise, pushing 10.25% in 2023.

We have discussed relational intensity at account opening (building relationships between customers/members and front office staff) and differentiation to make your new customers/members feel welcomed and valued, both of which can make an enormous impact on the length of your accountholder relationships.

But despite even our best efforts in the areas of account opening experience and differentiation, there will always come a time when customers/members want to close their accounts. When an accountholder comes into our branch to announce their intention to close, our response is often, “Okay, one moment, please.”

But how can we flip the script? What if banks and credit unions had dedicated retention specialists or even frontline staff trained to delve into the reasons behind the closure request and try to retain these relationships? The conversation might begin like this:

Frontline Staff or Retention Specialist: “I am sorry to hear that. May I ask if this is an account you no longer need, or are you moving the funds elsewhere?”

The accountholder’s response will likely dictate the rest of the conversation. Depending on their reason for wanting to close, here are a few possible responses that may salvage the relationship:

Consolidation: “It will only take a moment to close the account and transfer those funds into your remaining account.”

Moving Funds: “Can I ask, are you relocating, or did we do something to lose your trust?”

Relocating: “I know moving is challenging, but did you know that you can continue to bank here using our electronic services while living almost anywhere? If you have a few minutes, I can show you how!”

Lost Trust: “I am so very sorry to learn this. Can you please help me understand how we could have served you better?” And then, “Thank you for sharing this with me—I promise this information will get directly to the correct individuals. Let me ask you one more favor: Would you consider staying with us so you can see our demonstrated commitment to improving?”

Notice in that last interaction, the frontline staff member attempts to make the customer/member feel heard (“I am so very sorry to learn this”) and validated (“this information will get directly to the correct individuals”). The response also ends by asking the customer/member to stay long enough to be delighted by the products and services offered by the FI. It may be intimidating or difficult to hear customers/members say “no” to your final plea, but you will never know who you can truly help unless you ask for their business.

Using the branch experience to manage customer attrition is just as important as using the branch experience to generate organic growth, and amazing things happen when the two work in tandem. Realistically, banks and credit unions can’t retain every customer. But, by trying your best to retain more of them, your growth goals can become more manageable.