The following is the second in a series of three blogs addressing the importance of managing attrition in community financial institutions.

The battle for deposits continues to heat up for community FIs, and attrition remains a high priority.

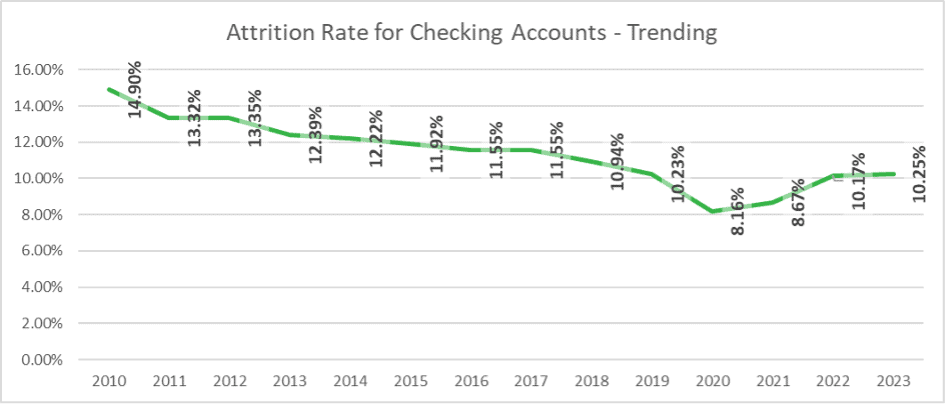

Since 2010, attrition at community banks—consumers leaving or switching financial institutions—declined from almost 15% to just above 8% in 2020. However, attrition has been on the rise since the pandemic, pushing to over 10% in 2023.

Is there a way your FI can work with new and existing customers/members to lower your attrition rates?

In a word, yes!

Community banking is about differentiation—in other words, caring about our clients and seeing them as individuals rather than just account numbers.

There are plenty of things you can do to establish positive and abiding relationships, many of which you are likely already doing. That said, we invite you to consider the following low- to no-cost ways to make your newest customers or members feel welcome within days of opening their account:

- Have the frontline employee who opened the customer/member’s account write and send a handwritten note to the new client. This brief personal note might thank the new client for their business, share some of the account features the client hasn’t taken advantage of yet, or remind the client to enjoy the free gift they got when they opened their account. These days, this kind of simple but powerful gesture is rare. Imagine how impressed your new customer or member will be just by receiving a thoughtful, personalized note!

- Give the new accountholder a call, preferably made by the team member who helped open their account. Just as with the note, this call can be brief—a simple “thank you” for their business, a reminder of features like online banking, and reassurance that you’ll be available whenever the accountholder has questions. Consider calling on Saturday or after working hours when the new accountholder is more likely to pick up the phone.

- If you have an email address on file, send your new accountholder an email thanking them for opening an account. This medium also offers the chance to go into more detail on features like online banking, bill pay, eStatements, and other digital banking services they may not be taking opportunity of!

In addition to the above direct and time-honored methods of making your new and existing relationships as personal as possible, we can also take great advantage of technology’s power to create connection.

“Wait: How can technology foster new and existing relationships?”

Glad you asked!

It is precisely for keeping accountholders engaged that Haberfeld created Fisionary™ and Fisionary+™. With Fisionary™, your institution will:

- Engage new accountholders and ensure they take advantage of the breadth of services and products you offer. Approximately 35% of bank customers and credit union members are single-product households, so the more they know about your offerings—and the more they engage with them—the more likely they are to stay.

- Create laser-focused email marketing based on your data to keep your institution top-of-mind. This can do much to turn accountholders into advocates who think of you first when they (or others) need a banking product or service.

- Boost your institution’s overall value and profitability by deepening these relationships and providing more products and services to more accountholders.

Why is it so crucial to stay in email contact with your new accountholders? According to a 2023 Gallup survey, fully engaged customers represent a 23% premium in share of wallet, profitability, revenue, and relationship growth over the average customer.

With this in mind, can you afford not to stay in contact with them?

For more information, visit our new Fisionary™ page today!