Examining impact to frequency and income

Case study subject: A bank with 20+ branches and nearly $2B in assets cut their overdraft fee from $37 to $18 in September 2022, a 52% reduction.

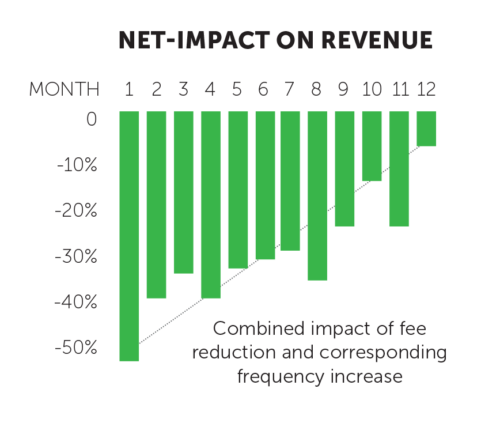

This bold choice provided unique data around consumer reactions to this overdraft fee reduction. We looked closely at the impact on income and service usage.

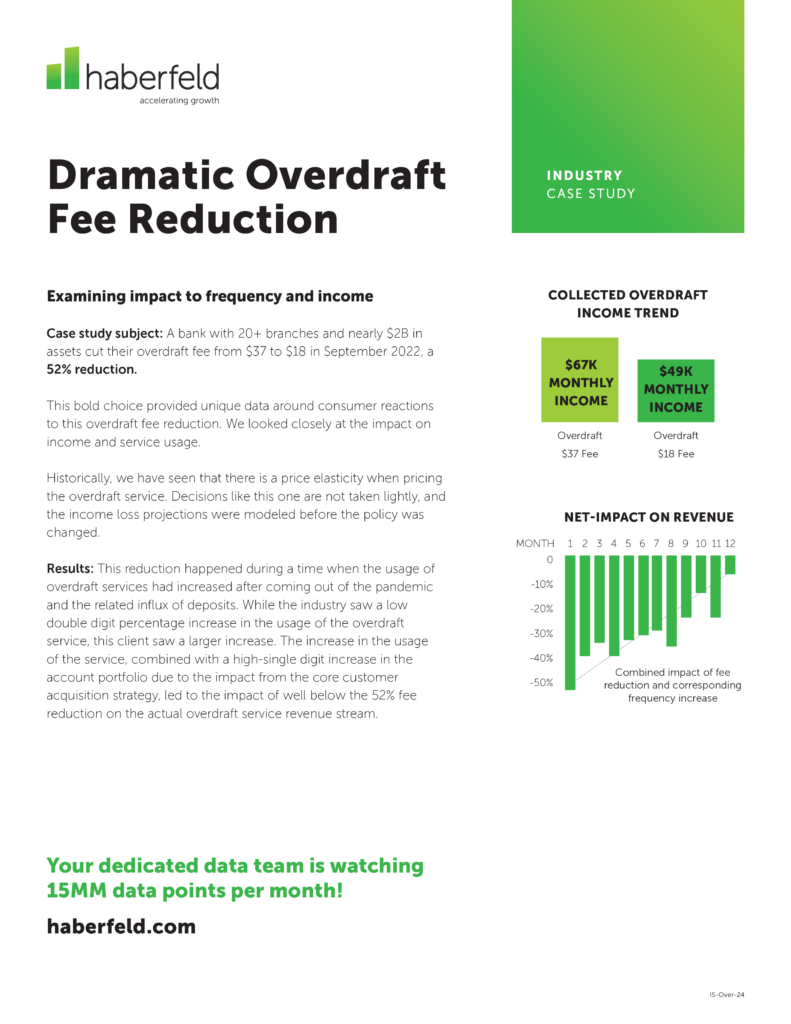

Historically, we have seen that there is a price elasticity when pricing the overdraft service. Decisions like this one are not taken lightly, and the income loss projections were modeled before the policy was changed.

Results: This reduction happened during a time when the usage of overdraft services had increased after coming out of the pandemic and the related influx of deposits. While the industry saw a low double digit percentage increase in the usage of the overdraft service, this client saw a larger increase. The increase in the usage of the service, combined with a high-single digit increase in the account portfolio due to the impact from the core customer acquisition strategy, led to the impact of well below the 52% fee reduction on the actual overdraft service revenue stream.

Your dedicated data team is watching 15MM data points per month!